Navigating Compliance Challenges in South Africa

The Compliance Landscape

In the rapidly evolving global financial sector, South Africa faces significant compliance challenges. A recent study by Forrester Consulting, involving 482 senior decision-makers across Europe, the Middle East, and Africa, highlights the growing costs and concerns related to compliance in the country.

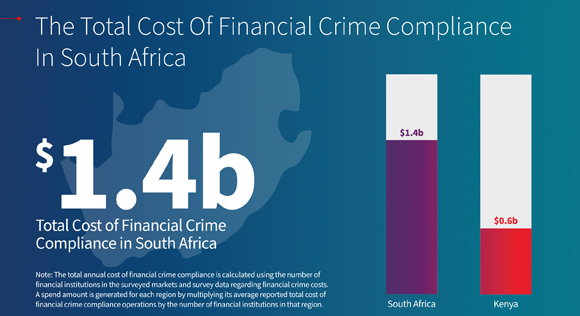

The Cost of Compliance

A staggering 98% of financial institutions report an increase in compliance costs. The primary cost factor is labor, reflecting the heightened regulatory demands and the need for professionals skilled in navigating complex compliance frameworks.

The Digital Revolution and Compliance

Amid the digital revolution, South African institutions are at a crossroads, balancing growth opportunities against emerging risks from new technologies. The study emphasizes the crucial role of technology, infrastructure, and external outsourcing costs in the overall financial crime compliance budget.

Emerging Threats

The study presents alarming statistics, indicating a rise in corruption, supply chain bribery, trade-based money laundering, and digital payment-related offenses. This trend underscores a heightened focus on international trade and the urgent need for efficient alert resolution mechanisms and robust customer risk profiling.

Dive Deeper

Explore our recent EMEA True Cost of Financial Crime Compliance Study for a deeper understanding of the challenges faced by South African financial institutions. Discover strategies for aligning compliance effectiveness with a seamless customer experience.

Delve deeper into key takeaways from the infographic:

- Rising Compliance Costs: An overwhelming 98% of financial institutions report an increase in compliance costs, primarily due to labor.

- Digital Revolution Impact: South African institutions are balancing growth opportunities against emerging risks from new technologies in the midst of the digital revolution.

- Emerging Threats: There is a noticeable uptick in corruption, supply chain bribery, trade-based money laundering, and digital payment-related offenses.

- Need for Efficient Mechanisms: The rise in financial crimes underscores the urgent need for efficient alert resolution mechanisms and robust customer risk profiling.

- Role of Technology and Outsourcing: Technology, infrastructure, and external outsourcing play a crucial role in the overall financial crime compliance budget.

This study serves as a vital educational resource, providing insights into the complex dynamics of financial crime compliance in South Africa, and enabling informed decision-making in a landscape of rapid change and uncertainty.